Medicare Fraudster Sentenced to 84 Months in Prison: A Lesson in Consequences for Healthcare Schemes

Gibbs was sentenced to 84 months in federal prison for committing healthcare fraud. The scheme involved billing Medicare for services that were either unnecessary or never provided, resulting in the…

Betrayal and Deceit: 47-Year-Old Lawyer Sentenced for Embezzling Hundreds of Thousands from Friend in Medical Crisis

A Meiningen judge sentenced Yvonne K., a 47-year-old lawyer, to five years and six months in prison for embezzling hundreds of thousands of euros from her former friend Mandy Ewald.…

Alert: Changes in Urine Color Could Indicate Kidney Failure – Seek Medical Attention Immediately

Kidney failure can be indicated by changes in urine color, such as amber, brown, or red. If you notice your urine changing color or becoming foamy, it’s crucial to seek…

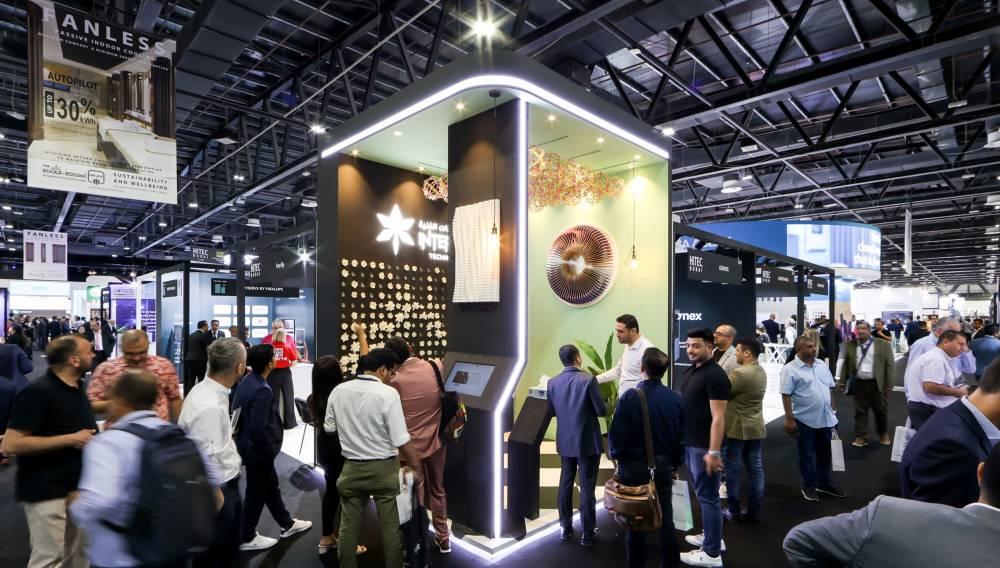

DMG Events Brings Together International Hospitality Community at 2024 Hotel Expo in Dubai”.

The 2024 Hotel Expo, organized by DMG Events, will be held from June 4 to 6 at the Dubai World Trade Centre. This international event will feature national pavilions from…

Google Podcasts to be Discontinued Internationally in Mid-to-Late June 2024

Google has recently announced that it will discontinue its content platform, Google Podcasts, internationally between mid-to-late June 2024. This news comes after the company had earlier stated in September 2021…

Topcon, Bentley Systems Partner to Enhance Geospatial Data Accuracy through GNSS Technology Integration

Bentley Systems and Worldsensing have recently announced a strategic partnership with Topcon Positioning Systems. The goal of this partnership is to integrate Topcon’s GNSS technology into the companies’ software and…

Microsoft Researcher and Meet Cute Founder Join Society for Science’s National Leadership Council

The Society for Science is thrilled to announce the addition of two new members to its National Leadership Council (NLC). Lester Mackey, a Principal Researcher at Microsoft Research, and Naomi…

Pike Avenue Partners Acquires SDS Technology: Celebrating 40 Years in Effingham and Expanding Cybersecurity Services

Pike Avenue Partners recently acquired SDS Technology, marking its 40th anniversary. The ownership group, consisting of the Bernie Blanchette, Paul Koerner, and Phil Koerner families, is excited to transition from…

Get Ready to Jump for Joy: The World’s Largest Bounce House Returns to Fraser with New Additions

The world’s largest bounce house is set to make a grand return to Fraser in May. This year, the event promises to be even bigger and better than before, with…

Revolutionizing Energy Infrastructure: The Latest Microgrid Trends and Innovative Solutions with Aron Bowman”.

In a recent interview, Aron Bowman, president of ELM MicroGrid and ELM Solar, discussed the latest trends in microgrid adoption and new technologies with Rod Walton, managing editor of Microgrid…