Align Technology Repurchases $150 Million in Common Stock, Strengthening Balance Sheet and Capital Ability

Align Technology (Nasdaq:ALGN) has announced plans to repurchase $150 million of its own common stock as part of its ongoing $1 billion stock repurchase program. This open-market repurchase comes after…

A.J. Brown Signs Three-Year Contract Extension with Eagles, Guarantees Minimum Career Earnings of $124 Million and Sets a New Standard for Receiver Contracts in the NFL

A.J. Brown has signed a three-year contract extension with the Eagles, which guarantees him a minimum career earnings of $124 million and sets a new standard for receiver contracts in…

ByteDance Stands Firm: TikTok Algorithm Not for Sale in U.S.

ByteDance, the parent company of TikTok, has declared that it will not sell the popular video-sharing app in order to continue its operations in the U.S. Despite facing potential ban…

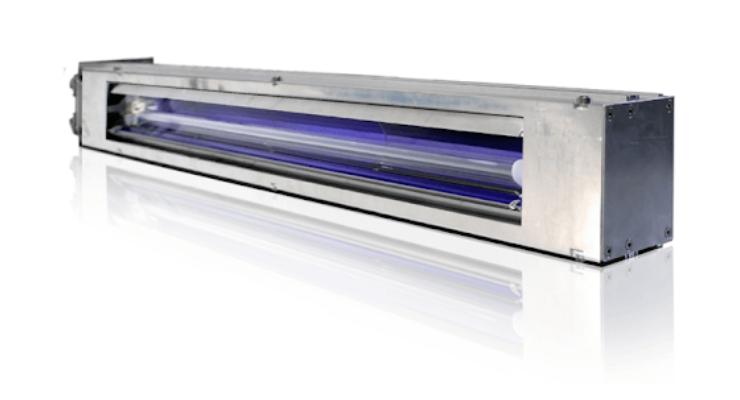

Revolutionizing UV curing technology: IST America & INTECH collaborate at RadTech

IST America (ISTA) is excited to be participating in the upcoming RadTech UV&EB Technology & Conference in Orlando, FL from May 20-22. At the conference, they will showcase their UV,…

WHO Scales Up Mental Health Support for Armenian Refugee Population through Mobile Teams and Hotlines

The World Health Organization (WHO) is dedicated to scaling up Mental Health and Psychosocial Support (MHPSS) services for Armenian refugee and host populations. Over the past six months, WHO has…

Tragic Death in Canton: The Dark Side of Police Custody and the Controversial Use of Face-Down Restraints

A resident of eastern Canton died in police custody last week after being handcuffed and left face down on the floor of a social club. The officers involved in the…

Fed’s Rate Cut Hopes Dash as Inflation Report Shows 2.7% Annual Rate

Despite the Federal Reserve’s aim of keeping inflation at 2%, recent reports have shown an annual rate of 2.7%. This has led to speculation that rate cuts may not be…

Scottish Conservative Party Launches No-Confidence Vote Against Chief Minister Yousaf: Implications for SNP and Scottish Politics”.

The Scottish Conservative Party has proposed a vote of no confidence against the Chief Minister of Scotland, Humza Yousaf. This is due to his unilateral decision to break the government…

CBS Sports Launches New 24-Hour Streaming Channel for UEFA Champions League Fans

Real Madrid player Jude Bellingham was seen celebrating during the UEFA Champions League quarter-final against Manchester City in a recent match. The excitement and energy of the game were captured…

Transform Your Business: Next Level Grant Program in West Monroe Launches with $500 and $250 Grants

The “Next Level Business Grant” program has been announced by Keep West Monroe Beautiful in collaboration with the City of West Monroe and the West Monroe West Ouachita Chamber of…