Empowering Young Entrepreneurs: Sharjah Chamber Unveils New Headquarters for Trade 101 Center

The Sharjah Chamber of Commerce and Industry has recently unveiled a new headquarters for the Small and Medium Enterprises Center “Trade 101” in Khor Fakkan. This expansion is part of…

Preparations Underway for Operation Rafah in Gaza Strip as Israeli Officials Face Opposition from International Community

Israeli officials have confirmed that preparations for Operation Rafah in the Gaza Strip are underway, with reports suggesting that the operation will begin “very soon”. A senior security official from…

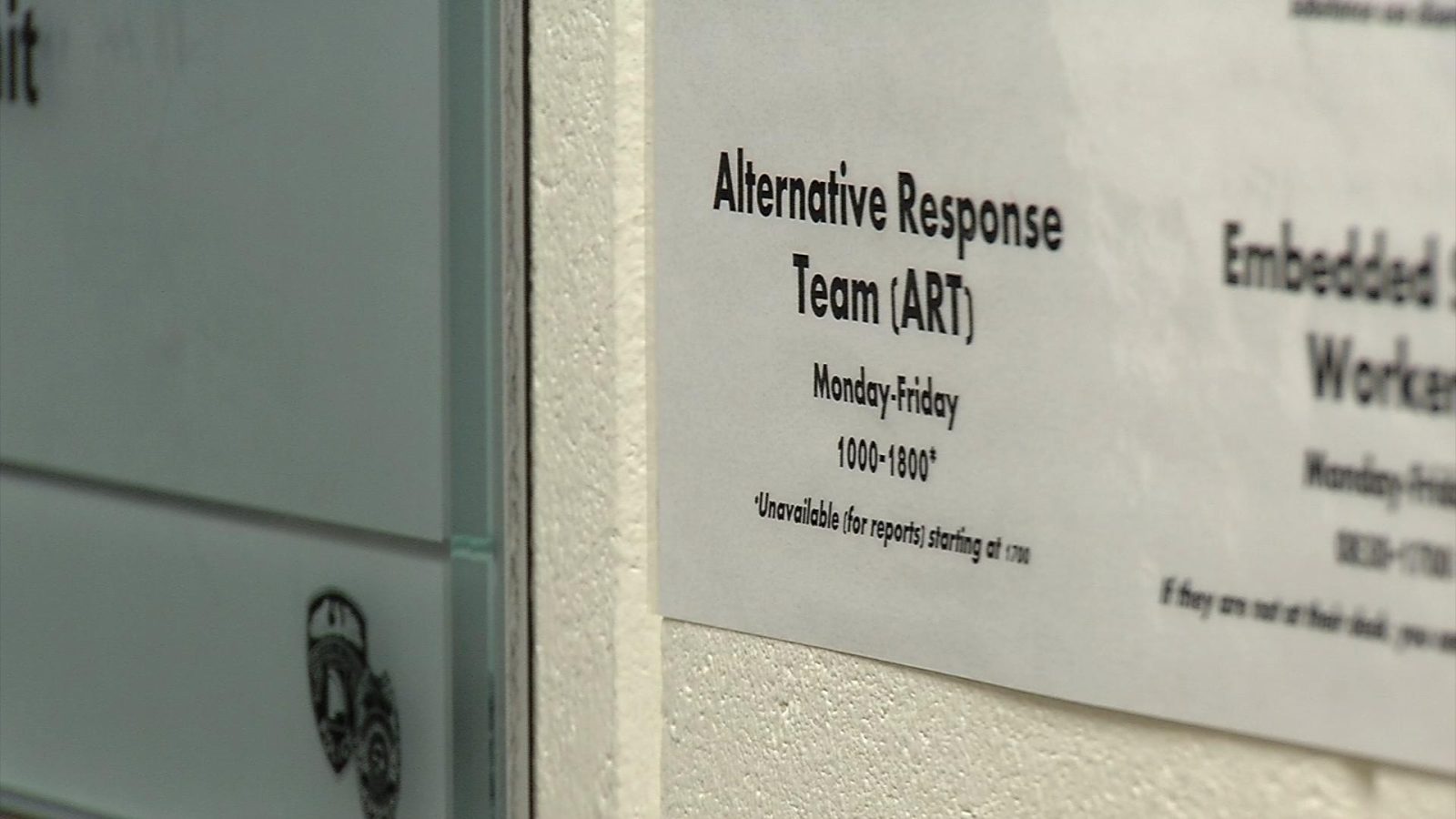

Hennepin County’s Alternative Response Team: How Healthcare and Law Enforcement Are Making a Difference in Mental Health Calls

Hennepin County social workers and North Memorial Health paramedics are now responding to mental health calls in the community instead of or alongside police officers. The Alternative Response Team project…

Swisscom Dives into Insurance: Exploring the Company’s Strategic Expansion and New Ventures

Swisscom has been making strategic business moves in recent years, expanding beyond its telecommunications roots and becoming an IT service provider and an insurance broker. This new venture includes a…

Sports Travel Industry Surges to Record $52.2 Billion in 2023, Creating Jobs and Boosting Economy

The sports travel industry experienced a total direct spending of $52.2 billion in 2023, with Americans taking a record 204.9 million sports event-related trips. According to the Sports Events and…

Breaking Barriers: Addressing Gender Inequalities in African Women’s Health with Global Leaders Awa Marie Coll Seck and Lia Tadesse Gebremedhin

In Africa, gender inequities pose a significant challenge to improving women’s health. A variety of factors, including poverty, economics, sexual and gender-based violence, contribute to these challenges. To achieve better…

Morningside University Receives $2 Million Donation for New School of Business Facility

Morningside University has received a $2 million donation from alumnus Tom Rosen to construct a new facility for its growing School of Business program. The donation will enable the university…

False Bomb Threat Evacuation at Euro-Airport Basel-Mulhouse-Freiburg; Multiple Articles and Blogs on Melbet

The evacuation of the Euro-Airport Basel-Mulhouse-Freiburg passenger terminal, located on French territory but on the border with Switzerland and Germany, was a result of a false bomb threat, as reported…

Bartlesville High Baseball Bids Adieu to Seniors in Style with Sweeping Win over Muskogee

Bartlesville High baseball completed its District season with a dominating performance against Muskogee. The team clinched a two-game sweep over the Roughers, with a thrilling 4-1 win at Rigdon Field…

Opioid Crisis Investigation: Did McKinsey Consulting Firm Aid in Deceptive Marketing Practices by Pharmaceutical Companies?

In recent years, the US Department of Justice has launched a criminal investigation into McKinsey consulting firm for its past advising of some of the largest opioid manufacturers in the…