The Prodigy Takes Chess Gold: Gukesh Dommaraju Makes History as the Youngest Candidates Tournament Winner

In 2021, Gukesh Dommaraju made history by becoming the youngest player to win the men’s Candidates chess tournament at just 17 years old. His triumph came after a tense final…

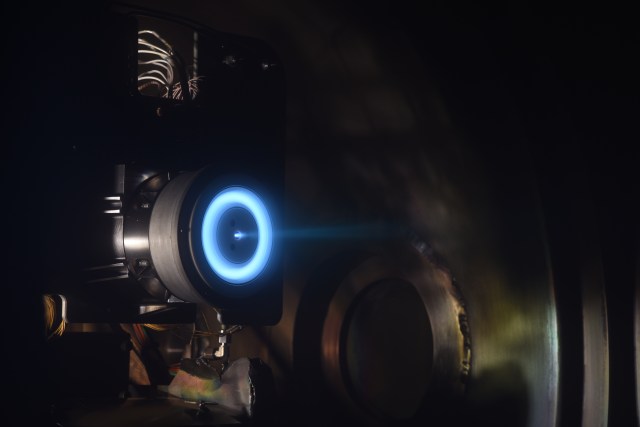

Revolutionizing Planetary Science: Electric Propulsion Systems for Small Spacecraft Missions

Small spacecraft missions for planetary science require propulsive maneuvers that are beyond the capabilities of typical commercial spacecraft. These maneuvers include achieving planetary escape velocities and capturing orbits, which require…

JD Expands Its Sportswear Empire with $1 Billion Acquisition of Hibbett

French businessman Regis Schultz, who leads JD, announced that the acquisition of Hibbett is highly complementary to JD’s business. This move by JD is in contrast to the trend of…

Revolutionizing the Future of AI: The Top 12 Pioneers and Key Players in Q1 2024

The first quarter of 2024 saw an unprecedented amount of funding poured into AI startups, as well as significant investments from AI and cloud platform providers. This led to a…

Brave Police Officers Rescue 46 Dogs from Burning Kennel: Viral Video Shows Incredible Act of Courage

On a Saturday night, a dramatic video emerged showing the moment when police officers bravely rushed into a dog kennel filled with heavy smoke to rescue 46 dogs in Fairfield.…

Discovering the Tangible World of Yves Klein: An Immersive Artistic Journey

Yves Klein and the Tangible World, currently on display at Lévy Gorvy Dayan until Saturday, May 25, 2024, is an exhibition that delves into the French artist’s unique approach to…

IOCL Chooses Lummus Technology for New Unit, Boosting Expansion Project and Long-Term Partnership

IndianOil Corp. Ltd. (IOCL) has selected Lummus Technology’s cumene technology for a new unit in Paradip, India. This unit is part of a larger petrochemical and polymers expansion project at…

Promoting Economic and Social Rights in the Face of Conflict: An Overview of Syria’s Struggle for Health and Human Rights

In the midst of ongoing conflict and crisis, Syria’s citizens are suffering from numerous violations of their economic and social rights. This document aims to provide an overview of these…

Kansas City Chiefs Finally Address Oversight by Giving Andy Reid a Substantial Pay Raise: The Importance of Proper Planning and Communication in Contract Negotiations

The Kansas City Chiefs have finally rectified a major oversight in their coaching staff by awarding head coach Andy Reid with a substantial pay raise. Despite being widely regarded as…

From Humble Beginnings: Jim Jacobs’ Journey to Family-Owned Business of the Year in St. Cloud

Jim Jacobs, a partner in the firm, took over ownership of Jacobs Financial in 1992 after the company moved to St. Cloud in 1979. The business has since grown to…