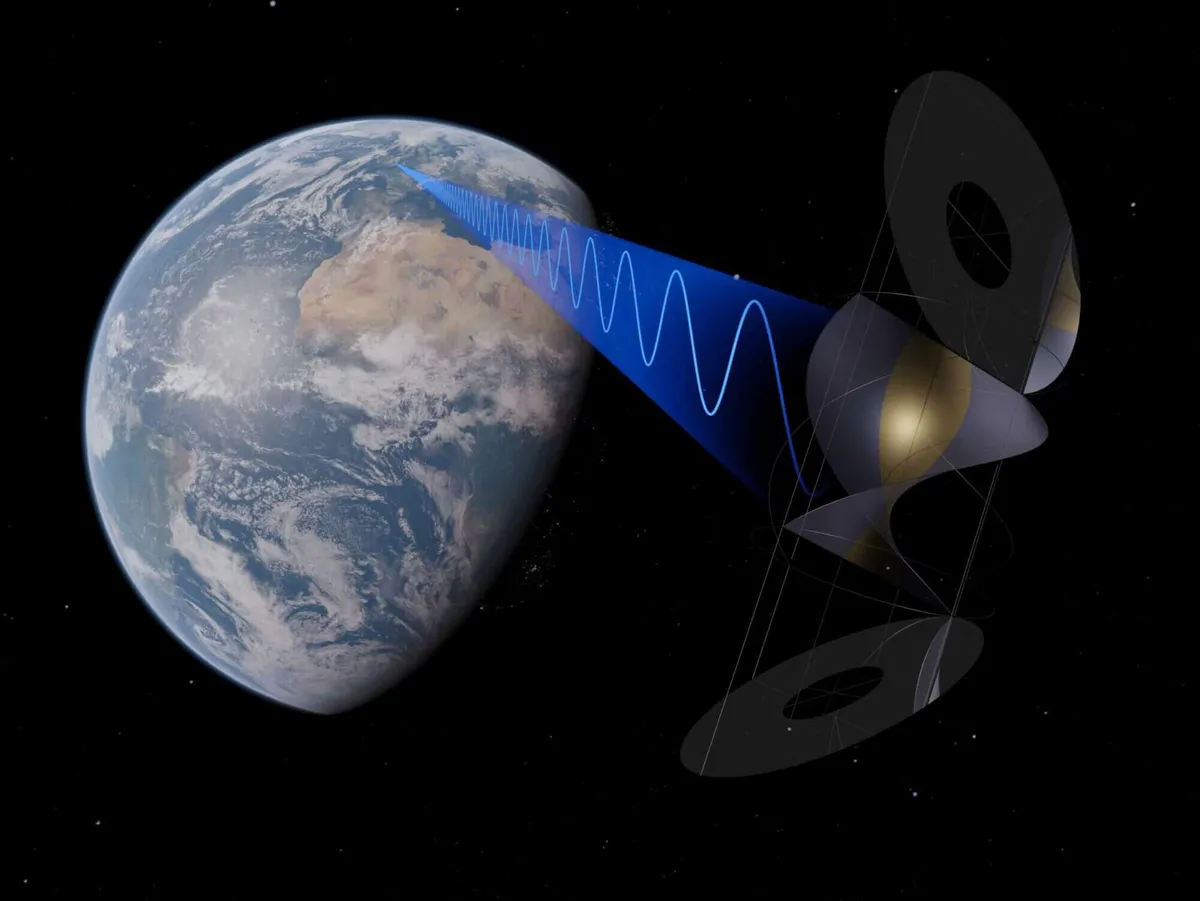

Breaking Ground: Space Solar’s Wireless Electricity Transmission Breakthrough Paves the Way for Space-Based Solar Power Plants

Solar and wind power production, which are dependent on weather conditions, require control power to manage fluctuations in production and consumption. As renewable energy production increases, the need for control…

Royal Bank of Canada Expands Services to Include Cash-Management Business for Fortune 1000 Companies

Royal Bank of Canada is expanding its services to include a cash-management business in Canada, a strategic move aimed at further meeting the needs of its clients and enhancing its…

Elise Stefanik’s Criticism of Biden’s Foreign Policy: Balancing Safety, Stability, and Diplomacy

Recently, Congresswoman Elise Stefanik, the Chairwoman, made a statement criticizing President Joe Biden’s foreign policy. She expressed her concerns about the current administration’s approach to international relations and believes that…

From Child-Centered Learning to Project-Based Education: A Comparison of High School Curriculums in the USA and Europe

Our high schools have a rigid curriculum where students are not given the freedom to explore their interests and passions. In contrast, American high schools offer electives that allow students…

The Rise of Women’s Basketball: Dawn Staley, Dawn Clark and South Carolina’s Historic Season Celebrated on National Stage

The highly anticipated basketball game between South Carolina and Clark, which took place earlier this month, was broadcast on ESPN and became the most-watched game at any level since 2019,…

Breaking World Records: Donna’s Journey to Success Through Plank Exercise

Twelve years ago, Donna Jean Wilde suffered a broken wrist that halted her training routine. In search of an alternative to physical activity, she discovered the plank exercise and quickly…

Mexico’s Appeal as an Investment Destination for Spanish Companies

Over the past few years, Spanish companies have increasingly chosen Mexico as their preferred destination for investment in Latin America. According to a report by IE University, over 82 percent…

New Entrepreneurship on the Rise: A Surge in Women and Minority Business Owners Amidst the Pandemic

New research has shown a surge in the number of people starting new businesses, with an increasing number of them being women and minorities. This trend began in 2020 at…

Israel to Target Iranian Proxies and Soldiers Abroad in Response to Attack on Israeli Territory

In light of recent events, it is believed that Israel will target Iranian proxy forces and soldiers abroad instead of directly attacking Iran. This is according to four US officials…

Google Enhances User Security with New Biometric Verification Option in Play Store

Google has recently updated its Play Store application to give users a new option for purchase verification. Instead of using a password, users can now choose to use biometric recognition,…