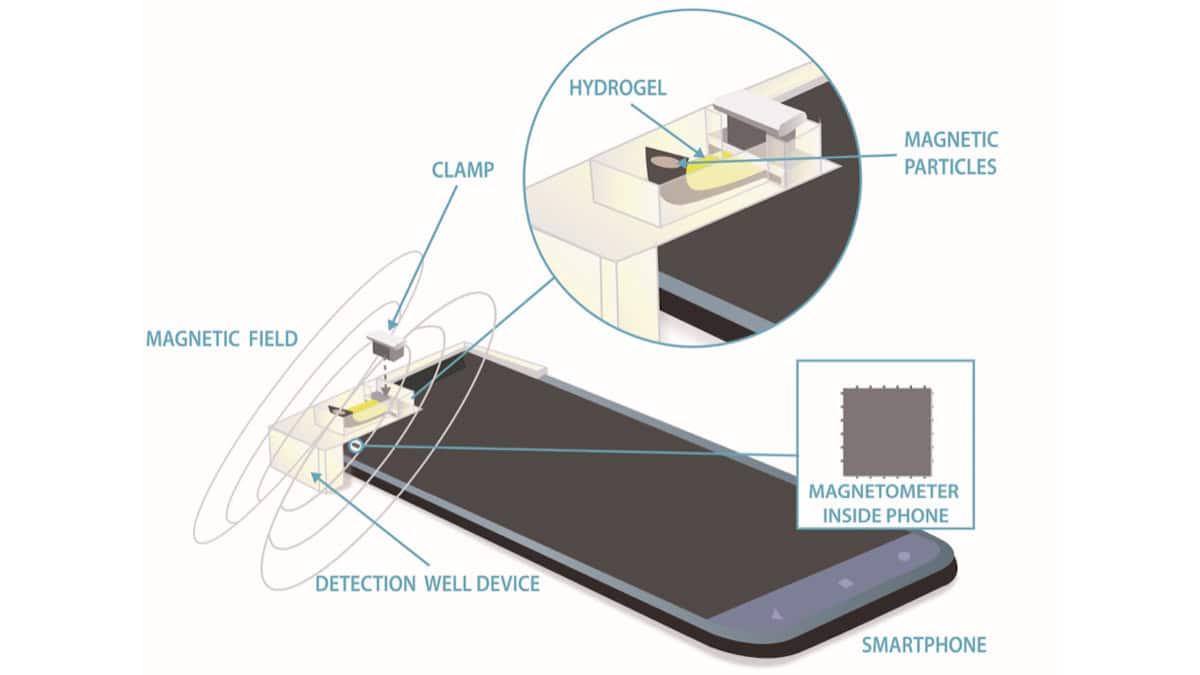

Revolutionizing Substance Analysis: NIST Develops Innovative Magnetics-Based Analyte Sensor

Researchers from NIST have successfully developed a magnetics-based analyte sensor that shows promising results in detecting substances. This sensor leverages the principles of magnetism to accurately identify different analytes in…

Unleashing Resilience: Join San Diego’s Community for a Walk to Promote Mental Wellness

San Diego residents are invited to take part in the annual San Diego NAMI Walks and Mental Wellness Expo on April 27, 2024. The event, which has the theme “I…

Serious Offense: Deliberate Disruption of Traffic on Yerevan-Yeraskh Highway with Burning Tires

On April 24, criminal proceedings were initiated against a group of individuals who were responsible for disrupting traffic on the Yerevan-Yeraskh highway using burning tires. The incident occurred at 4:25…

Aftermath of Gun Violence: The Importance of Seeking Professional Help from Horizon Behavioral Health

Gun violence continues to plague public spaces in the region, with incidents ranging from a Waffle House to an apartment complex. Witnessing such traumatic events can have a significant impact…

Reckoning with Sexual Assault and Cryptocurrency: The Aftermath of Harvey Weinstein’s Rape Conviction Reversal

The decision to overturn Harvey Weinstein’s rape conviction has sparked a new chapter in America’s reckoning with inappropriate sexual behavior by powerful individuals. This ruling was based on the testimonies…

San Diego NAMI Walks and Mental Wellness Expo: I am NAMIWALKS

The annual San Diego NAMI Walks and Mental Wellness Expo is taking place this Saturday, April 27, 2024. Organized by the National Alliance on Mental Illness in collaboration with the…

Six Minnesota Breweries Take Home Medals at the World Beer Cup Awards

In California, the Canyon Club microbrewery restaurant was buzzing with excitement on July 4, 2021 as patrons savored a close-up glass of Beta Tested Pilsner. Meanwhile, back in Minnesota, several…

Stock Market Takes a Hit: S&P 500 Declines by 1.4%, Led by Communication Sector Stocks

On Thursday, the stock market experienced a significant drop, led by the decline in communication sector stocks. The S&P 500 fell by 1.4 percent, while the Nasdaq and Dow Jones…

Daring Humanitarian Flotilla Heads Towards Gaza, Despite Israel’s Interdiction Efforts

A group of pro-Palestinian activists from various countries is preparing to send a humanitarian aid flotilla to the Gaza Strip from Turkey. The 75 participants include intellectuals, journalists, former politicians,…

Exploring the Future of Robotic Vision: The Impactful Work of Takeo Kanade on Artificial Vision and Ethics

Takeo Kanade, a 78-year-old from Japan, has dedicated over 40 years to the field of artificial vision, a scientific discipline that allows us to see the world from different perspectives.…