Boviet Solar’s First North American Plant to Boost North Carolina’s Economy by $300 Million

In a major announcement, Boviet Solar, a Vietnamese-based company, has unveiled its plans to construct its first North American solar panel manufacturing plant in eastern North Carolina. The plant will…

New Border Posts Installed on Armenian-Azerbaijani Border as Part of Ongoing Efforts to Demarcate Border

Currently, a total of 28 border posts have been installed on the Armenian-Azerbaijani border as part of the ongoing coordinate adjustment works. This represents approximately 35% of the planned works,…

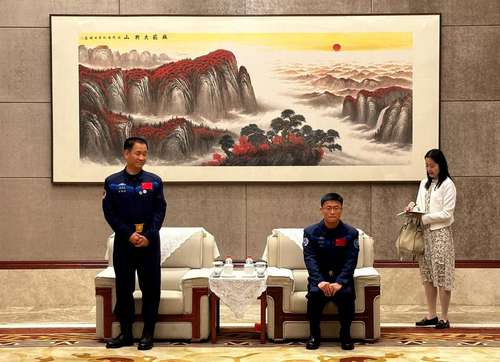

Cooperation in the Void: China, Latin America, and the Caribbean Unite in Space Exploration and Development

The first Cooperation Forum Space Conference of China, Latin America, and the Caribbean took place in Wuhan. During this conference, agreements were reached on collaborating on lunar and deep universe…

Chargers Deny Interest in Trading QB Justin Herbert as They Draft Notre Dame OT Joe Alt

The Los Angeles Chargers reportedly received trade requests from the New England Patriots and Minnesota Vikings for star quarterback Justin Herbert prior to the 2024 NFL Draft. However, Chargers general…

Riverview Health and Rehabilitation Center’s 2024 Prom Celebrates Community, Improves Quality of Life for Residents

The director of Business Development at Riverview Health and Rehabilitation Center, Misty Harvest, recently shared that many residents who do not typically participate in events like this were excited to…

Alphabet Surges on Wall Street: First Dividend, Better Earnings Propel S&P 500, Nasdaq and Dow Jones Higher, While Intel Disappoints

Alphabet, the parent company of Google, experienced a surge in its stock value on Wall Street after announcing its first dividend and reporting better-than-expected earnings. The S&P 500, Nasdaq, and…

Tornado Strikes Garner Industries in Lancaster County, Injuring Three Workers

A tornado hit Garner Industries, a business located in northeast Lancaster County, on Friday afternoon while 70 workers were inside. The tornado struck the building near N 98th Street and…

Iranian Women Face Stricter Violence, Arrests and Harassment under Hijab Enforcement: Two Years after the Death of Mahsa Amini.

Two years after the tragic death of Masha Amini, Iranian women continue to face danger in their own country. The UN High Commissioner for Human Rights has reported that controls…

Instagram Enhances User Control with New Features: Hidden Words Option and More!

Instagram has recently launched new features that give users more control over their social media experience. One of these features is the hidden words option, which allows users to filter…

Seahawks’ Newest Addition Byron Murphy II Embraces His Unlikely Draft Status and Talks About Fitting into Seattle’s Scheme

The newest addition to the Seahawks, Byron Murphy II, joined Brock and Salk on Seattle Sports 710AM the morning after being drafted. He expressed his gratitude for being selected at…