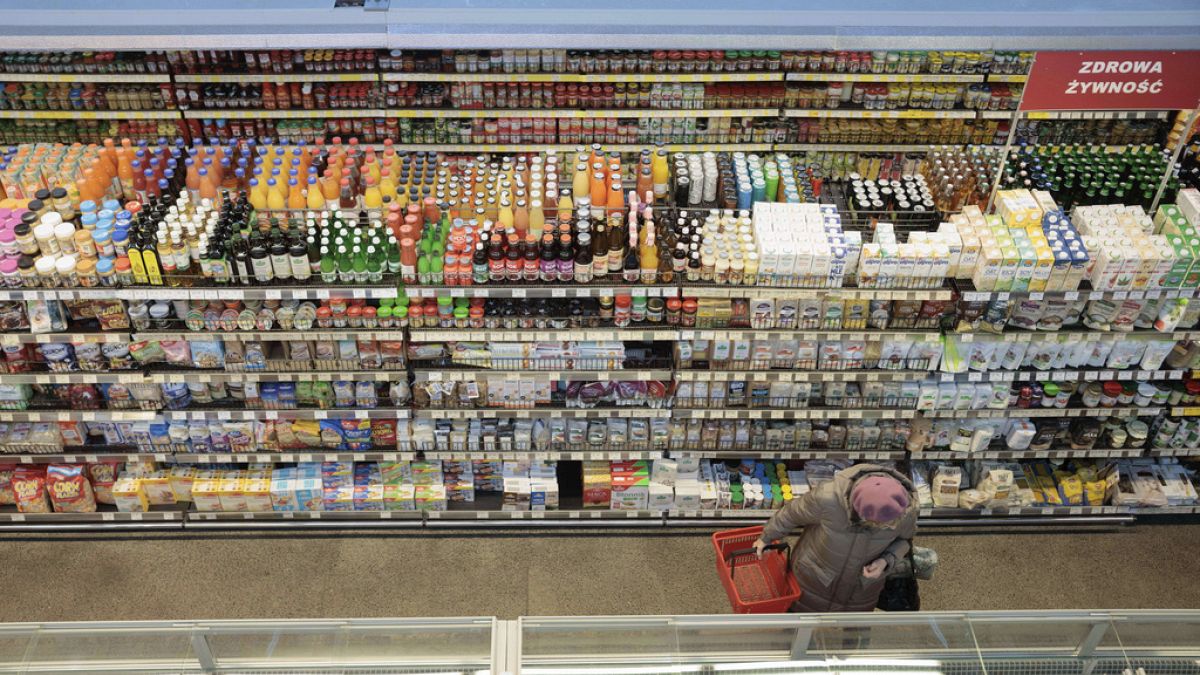

Despite a recent drop in inflation rates, Poland’s central bank governor remains cautious about the potential for it to reignite due to higher food taxes and the possibility of removing energy price limits. The Monetary Policy Council (MPC) has expressed concern about the uncertainty surrounding inflation fluctuations, which are largely driven by fiscal and regulatory policies, economic recovery pace, and labor market conditions in Poland.

In March, Poland’s annual inflation rate fell to 1.9% from 2.8% the previous month, surpassing market expectations of 2.2%. However, Finance Minister Andrzej Domanski has suggested that lower interest rates could benefit the economy and budget. While some members of the MPC support further rate cuts, a majority is hesitant to do so until the impact of government energy pricing plans on inflation is confirmed. As a result, it is expected that the central bank will maintain its interest rate at 5.75% for the seventh consecutive meeting, as reported by a Bloomberg survey of economists. Central Bank Governor Adam Glapinski has expressed reluctance to cut borrowing costs, citing fears of inflation rising again.